The aerospace industry has taken a drastic fall with the COVID-19 pandemic in 2020. Investors are now wondering when commercial aviation will return to 2019 economic levels and are skeptical about the industry’s future.

Slow recovery?

Raytheon Technologies CEO, Greg Hayes recently stated to media that it is going to be a slow recovery, perhaps it’s going to take years, adding the timing of recovery is equally important. Slow down in commercial air travel has impacted original equipment sales and aftermarket service for aircraft engine manufactures like General Electric and Raytheon. Engine services are key areas of earnings for manufacturers. Hayes said that he was assuming a 2- or 3-year long recovery time for the industry, with economic stabilization in 2023 or 2024.

Narrow-body aircraft vs. wide-body aircraft

Raytheon CEO, Greg Hayes is looking at a bifurcation in the recovery times for narrow-body aircraft and wide-body aircraft. While narrow-body jet aircraft are primarily used for domestic travel, their recovery is assumed to be quicker than wide-body aircraft, which rely on international and intercontinental travel, and will recover more slowly due to international travel bans. This is certainly not good news for General Electric and Boeing.

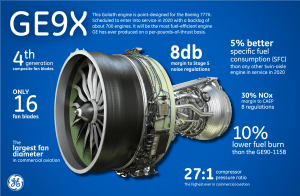

Boeing was hopeful of a pickup in wide-body aircraft orders at the beginning on 2020, considering the increased demand for the 787 and the new 777X. General Electric has been impacted because their next gen GEnx aircraft engine is one of the two options for the Boeing 787, and the 777X would receive the GE9X currently under development. Boeing has no choice but to cut production of its wide-body aircraft.

What about defense aviation spending?

With the slowdown in commercial aerospace, investors are now looking at companies in close relation to the defense sector. Hayes mentioned that the defense aviation budget will go down, and is uncertain about the areas of spending.

Raytheon is relatively safe considering its exposure to electronic warfare, intelligence communications and cyber protection. However, questions are being asked about companies involved in traditional military hardware.

Prospects for leading aviation players

Indeed, investors are feeling negative about the outlook for all leading aerospace companies. The last thing they need is a longer recovery timeline in commercial aviation.

If wide-body aircraft demand doesn’t recover in time, Boeing and General Electric are seen to be taking a hit, especially since Boeing has an edge over Airbus in this segment, and General Electric over Raytheon for aircraft engines. Wide-body aircraft make big profits for Boeing, and General Electric is heavily invested in providing engines for these aircraft, for example the GE9X aircraft engine for the Boeing 777X, with the hope of aftermarket revenue forecasts.

Raytheon is relatively safe for now

Raytheon is looking at a quick recovery time, and its defense investments look well sorted, enough to support the company during difficult times for commercial sectors. Raytheon financial experts expect a $2 billion free cash flow for 2020, as the company absorbs the economic downturn following COVID-19. Financial analysts are assuming this will bounce to nearly $6 billion by 2021. Given the current market cap of $91.6 billion and a speedy recovery time thereafter, Raytheon is a good value stock right now.